On Thursday, a federal judge approved the $290 million settlement of a class-action lawsuit brought by the sex abuse victims of Epstein against JPMorgan Chase—a close mutual business associate of both Gates and Epstein.

Over this past year, JPMorgan has agreed to pay an additional $75 million—for a combined total of $365 million—to settle another lawsuit relating to its established banking relationship with Epstein. The suits revealed that JPMorgan facilitated approximately $1 billion in transfers for Epstein which the bank admitted were “human trafficking” related.

Gates’s relationship with Epstein has been widely known and was even cited by Gates’s ex-wife, Melinda, in the couple’s 2021 divorce proceedings. Bill Gates has denied having any involvement in Epstein’s crimes.

Gates and Epstein’s mutual associates, James E. “Jes” Staley and JPMorgan Chase, were central to Gates’s relationship with Epstein. Gates’s close contacts with Epstein began around 2011, when he and JPMorgan were teaming up to create a global health investment fund, the activities of which are documented extensively in Controligarchs.

As a top executive at JPMorgan, Staley introduced Epstein—an important bank client—to Gates and the two hit it off. Gates flew aboard Epstein’s private jet, met with him “many times,” and visited his home on at least three occasions, despite Epstein’s 2008 conviction for solicitation of a minor, the New York Times reports.

Last year, several of Epstein’s victims and the U.S. Virgin Islands (where the pedophile financier maintained a residence) filed suit against JPMorgan, accusing the bank of enabling the illegal activities of Epstein and his network.

The litigation revealed that JPMorgan admitted to the Treasury Department that it had facilitated more than $1 billion in transfers relating to “human trafficking” by Epstein. To avoid going to trial, JPMorgan agreed to pay $290 million to Epstein’s victims and $75 million to the U.S. Virgin Islands, bringing the combined total to $365 million for these settlements.

In March 2023, JPMorgan, in turn, sued Staley, its former chief of investment banking, claiming that he should pay “the entire amount” of the litigation costs, thus effectively blaming him for the scandal. The litigation revealed that Staley allegedly “used aggressive force in his sexual assault of [anonymous victim] and informed [her] that he had Epstein’s permission to do what he wanted to her.”

James “Jes” Staley, CEO of JPMorgan Chase & Co.’s investment bank, speaks during the Bloomberg Markets Global Hedge Fund and Investor Summit in New York City on May 5, 2010. (Daniel Acker/Bloomberg via Getty Images)

After months of shocking disclosures, including that JPMorgan executives ignored “numerous warning signs” to keep Epstein as a client, the bank settled and avoided going to trial which was set for last month.

Staley settled with JPMorgan less than two months ago for an undisclosed amount. Both the bank and Staley maintain that they had no knowledge of or involvement in any of Epstein’s crimes.

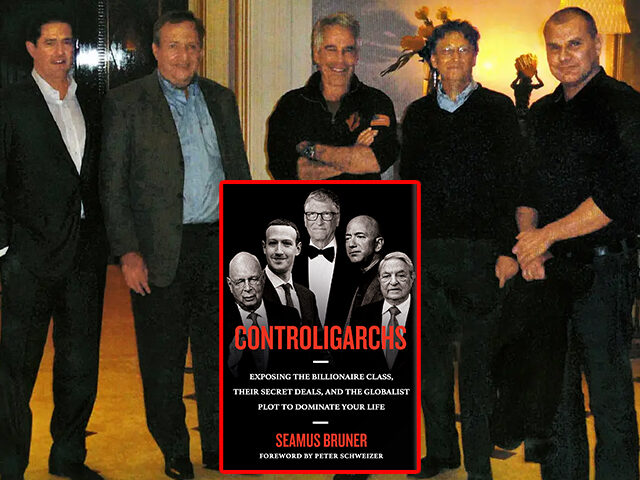

Notably, the only public photograph of Epstein with Gates was a photo obtained by the New York Times showing the men flanked by Staley and Boris Nikolic, the Gates Foundation’s science adviser, at Epstein’s Manhattan mansion in 2011. It was around this time that Gates’s and JPMorgan’s global health investment business, which....

Read More HERE

Nice but, where's the client list?

ReplyDeleteThe client list is in J Biden's garage, next to the 'Vette and the remaining J6 video evidence.

ReplyDeleteWe will never see the client list. It is being used by the Deep State to control politicians, judges, and others.

ReplyDelete