Ninety miles from the South Eastern tip of the United States, Liberty has no stead. In order for Liberty to exist and thrive, Tyranny must be identified, recognized, confronted and extinguished.

infinite scrolling

Wednesday, December 25, 2019

Merry Christmas America! Corporations Brought Back $1 Trillion From Overseas Due to Trump Tax Plan

For decades before President Donald Trump’s tax plan took effect, U.S. corporations with foreign subsidiaries had no (sane economic) choice but to keep their overseas profits abroad. After all, they’d face double taxation if they wanted to bring them home. Their profits were already taxed by the foreign country they’re operating in, and then to repatriate those funds would’ve required them to pay the U.S. corporate tax rate, which was then among the highest in the world. By year end 2017, right before Trump signed his Tax Cuts and Jobs Act (TCJA), upwards of $2.5 trillion in cash was parked overseas.

The TCJA reduced the corporate tax rate from 35% to 21%, but offered extra incentives to repatriate cash. After all, we’d rather have that money in America for economic reasons regardless of how much the government can get their hands on. The Trump tax law allowed corporations to repatriate cash at a discounted 15.5% tax rate, and a reduced 8% rate to repatriate other assets that are non-cash or illiquid.

While estimates differ on how much cash was parked overseas pre-TCJA, between 40% and 66% has made its way back to America.

According to Bloomberg:

Corporations have brought back more than $1 trillion of overseas profits to the U.S. since Congress overhauled the international tax system and prodded companies to repatriate offshore funds, a report showed. The flow rose to $95.3 billion in the third quarter from a downwardly revised $70.4 billion in the previous three months, according to Commerce Department data, reaching a total of $1.04 trillion since the end of 2017.Investment banks and think tanks have estimated that American corporations held $1.5 trillion to $2.5 trillion in offshore cash at the time the law was enacted.

For as much as liberals will try to convince you...

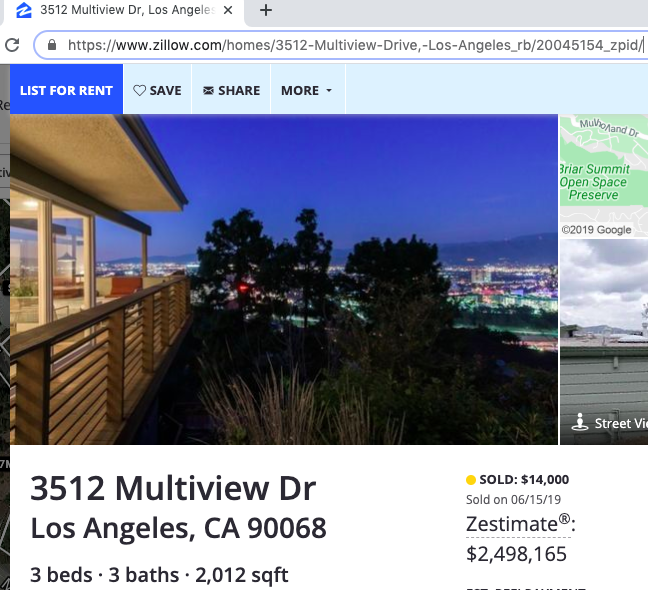

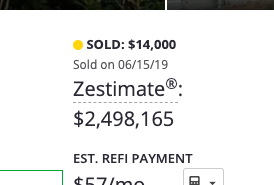

ZILLOW: Hunter Biden buys $2.5 million LA pad — for $14,000

It pays to be a Biden.

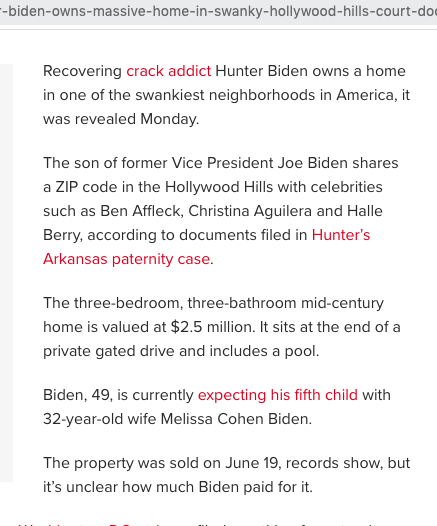

Hunter Biden, former vice president Joe Biden’s son, bought his Los Angeles home earlier this year at a deep, deep discount, Ann Coulter says.

The columnist posted a screenshot of the Zillow listing for Biden’s LA house, which is estimated to be worth nearly $2.5 million.

Hey, Republicans! Anyone want to look at this?

HUNTER BIDEN BOUGHT A $2.5 MILLION HOLLYWOOD HILLS HOME IN JUNE FOR $14,000

11K people are talking about this

But the site states the house, estimated to be worth $2,498,165, sold for just $14,000 in June.

That’s a 99.5 percent discount!

The three-bedroom, three-bathroom home “sits at the end of a private gated drive and includes a pool.”

It appears to be the home where Biden conducted an interview with ABC News’ Amy Robach.

Biden is in the midst of a paternity claim from an Arkansas woman who recently proved her baby is his.

Fox Business reports:

The mother of Hunter Biden’s child says the son of former vice president and Democratic presidential contender Joe Biden is refusing to answer any questions pertaining to his “basic” lifestyle and finances as the hearing in their tumultuous paternity case approaches, court papers show.

Lunden Roberts and the younger Biden are embroiled in a bitter court battle in Arkansas surrounding their 16-month-old baby, whom Roberts has argued he should support, according to court records and multiple reports.

Court documents claim Biden “has provided no support for this child for over a year. The Court should not let the defendant continue to avoid his natural and legal duty to support his child by failing to provide basic information about his income, finances, and lifestyle.”

Biden was paid as much as $50,000 a month for work on the Burisma Holdings board, according to...

Subscribe to:

Posts (Atom)