It appears as though the coronavirus is spiraling out of control.

From CNBC, "More than half of China extends shutdown over virus":

The majority of China’s growth hubs have delayed the resumption of business by at least a week as the country tries to control the spread of a new coronavirus that has killed more than 200 people.

As of Monday morning, at least 24 provinces, municipalities and other regions in China have told businesses not to resume work before Feb. 10 at the earliest. That’s according to publicly available statements from the governments.

Last year, those parts of China accounted for more than 80% of national GDP, and 90% of exports, according to CNBC calculations of data accessed through Wind Information. As a result, these delays in getting back to work could have a significant impact on the growth and international trade of what is now the world’s second-largest economy.

Drone footage shared by ABC News shows the streets in Wuhan are nearly empty:

Drone footage shows almost empty streets in typically bustling Wuhan, China, amid a citywide lockdown over the deadly coronavirus outbreak.— ABC News (@ABC) February 4, 2020

The viral outbreak has infected more than 20,600 people globally. https://t.co/K9g7lCir38 pic.twitter.com/ZctumKNM1Q

A Russian expat shared video from inside of Wuhan amidst the quarantine:

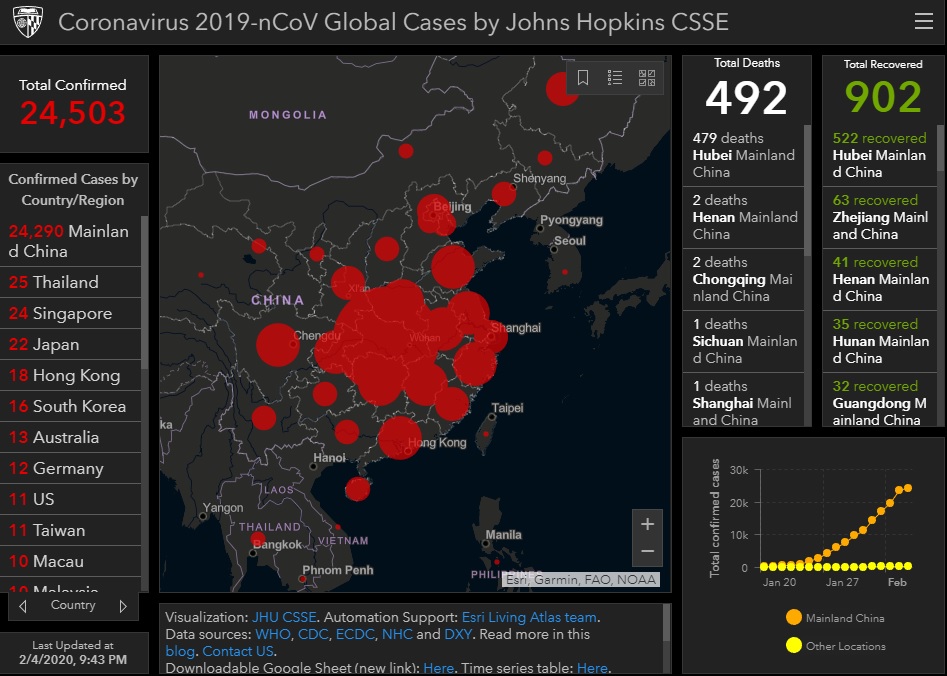

There's at least 24,503 confirmed cases of the coronavirus worldwide and 492 deaths according to the official numbers.

Note: you can ignore the last marker on Johns Hopkin's chart above which makes it look like it's slowing down, that's just a programming bug which happens when they do partial updates in between days, so far every night when the...