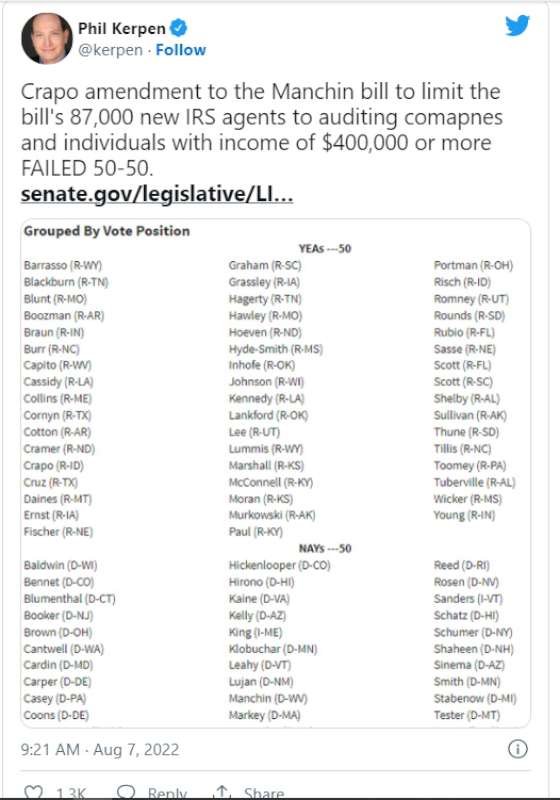

Welp, it looks like Sen. Crapo tried to make sure the 87,000 new IRS agents Democrats want to bring in won’t be targeting the middle and lower class … and Democrats voted that down. So the next time anyone on the Left or a Democrat claims they care about the middle class you can use this to call BULLS**T.

This is obnoxious.

Democrats don’t want their wealthy pals aka their wealthy donors audited.

But you little people? Psh.

Because they don’t need to hire new agents to target them … this is all about the middle class paying THEIR fair share.

They just think people are too stupid to know better.

just blame the old rich white guy who likely has Dementia in the White House. They’ll use this to keep him from running again in 24.

While the rest of us get stuck with higher taxes DURING A RECESSION, with a massive and armed IRS...