Dear Diary: Today I really zinged Drumpf good.

CNN’s fake news king Jim Acosta asked President Trump Wednesday if he had investments in the hydroxychloroquine drug, despite the fact that the claim has been proven completely false by several fact checkers.

‘No, I Don’t. Good Question’ the President deadpan replied as he walked out of the press briefing.

Trump on Obama: "He's know something [about Joe Biden] that you don't know. That I think I know. But you don't know." pic.twitter.com/gA30s1JnII— Aaron Rupar (@atrupar) April 8, 2020

Trump was walking out of the press briefing and scumbag Jim Acosta was screaming a question to Trump about his $29 investment in a company that manufactures hydroxychloroquine.

There is no bigger fool in America than Jim Acosta.

1,668 people are talking about this

The implication was that Trump is pushing hydroxychloroquine because he can make money from it.

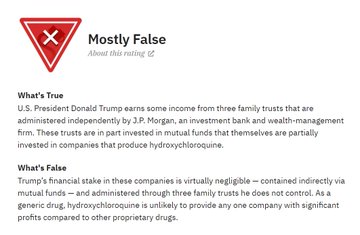

However, the investment Trump has is so small that even the uber-liberal fact checker Snopes rated the Times story “Mostly False.”

The Daily Caller noted that “Trump’s personal stake in the company is estimated to be as small as $99.”

Brutal day for The New York Times. The worst of the worst at The Washington Post, Vox, and Snopes were like "yeah that's a pretty ridiculous fake news narrative."

1,467 people are talking about this

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

He a small stake that comes out to 4 hundred dollars and some change...move on

See *FiddleSticks*'s other Tweets

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

If he has it bundled in a mutual fund... is that really an investment. He might not have even known it was there.... Snopes is a joke anyway.

See Krista Hilton's other Tweets

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

Trump has $500 (as a percentage) in a mutual fund in a blind trust. Agggggghhhhh

See sdnerf's other Tweets

Trump is asked by @Acosta if he has any investments in hydroxychloroquine.

"No I don't"

Snopes rated this claim "mostly false"dailycaller.com/2020/04/08/sno…

Snopes is a divorced dude working out of his basement. Let’s get a fact check on that snopes.

See M&M's other Tweets

Of course, the media’s approach to anything now is ‘if orange man says it’s good, it must really be...